Understanding Cloning Credit Card Techniques: A Comprehensive Guide

In today's digital economy, the phrase "cloning credit card" often surfaces in discussions about cybersecurity and financial safety. Cloning credit cards refers to the process of duplicating someone else’s credit card information and using it without their consent. This act is not only illegal but poses significant risks to businesses and individuals alike.

The Evolution of Credit Card Technology

The advent of credit cards revolutionized the way consumers engage in commerce. Initially, credit cards involved simple mechanisms for transactions. However, as technology advanced, so did the methods of fraud. Understanding the history and evolution of credit cards is crucial in recognizing how practices like cloning credit card have emerged.

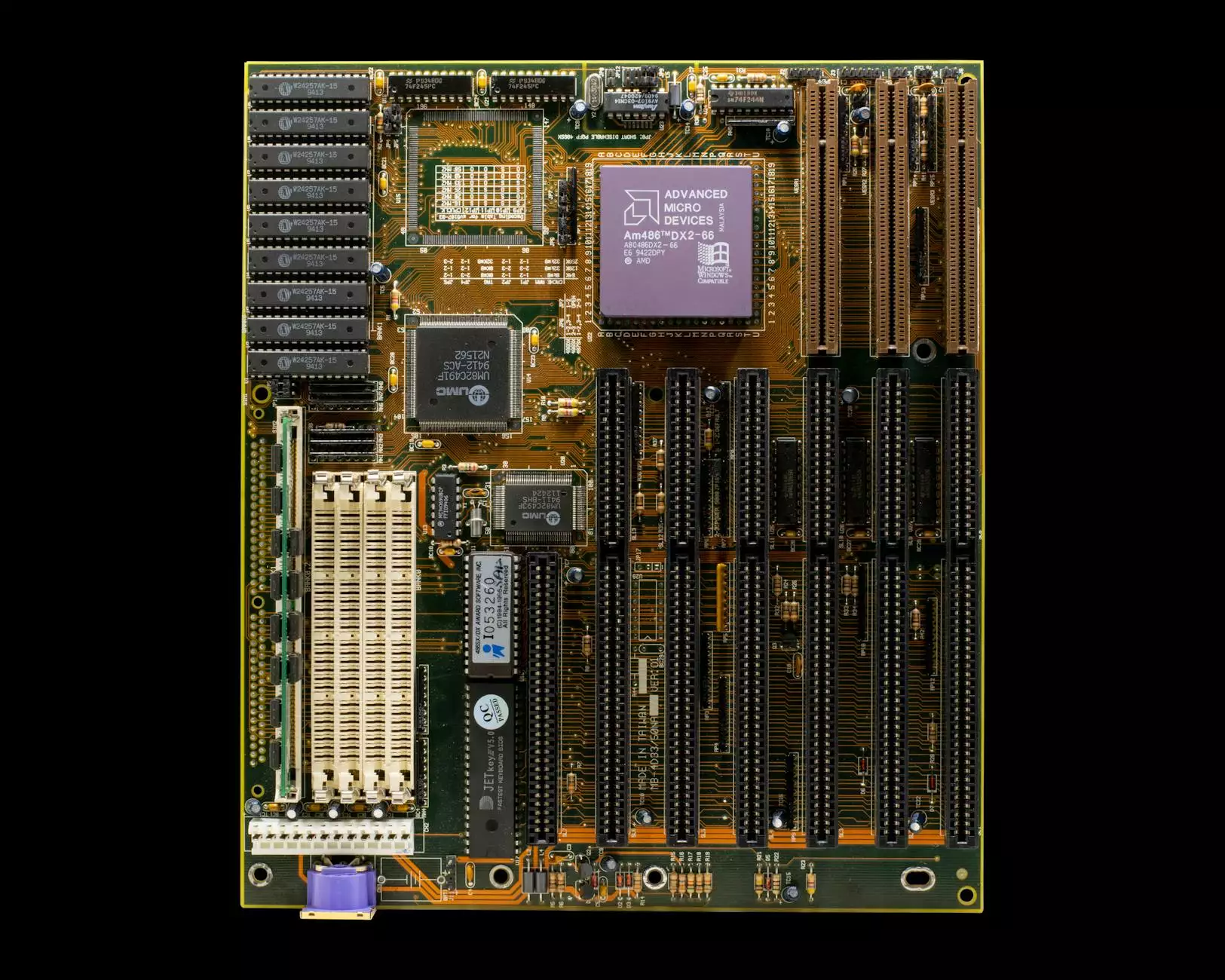

From Magnetic Stripes to EMV Chips

Credit cards began with magnetic stripes that contained straightforward, easily accessible information. Unfortunately, this made it simple for fraudsters to clone cards using devices known as skimmers. With time, the introduction of EMV chips brought about enhanced security. EMV (Europay, MasterCard, and Visa) technology uses encrypted data, making it significantly harder for criminals to clone credit cards.

How Does Cloning Credit Card Work?

The cloning process typically involves two main tactics: skimming and phishing. Both methods are ingenious, requiring a basic understanding of technology and human behavior.

Skimming: A Direct Attack on Transaction Points

- Skimmer Devices: These devices are often attached to ATMs or point-of-sale terminals. When a credit card is swiped, the device captures the card data.

- Counterfeit Cards: After obtaining the data, fraudsters can create a physical replica of the card using various materials.

Phishing: Manipulating Human Trust

Phishing is another method used by fraudsters to clone credit cards. This technique relies on deceit, where individuals receive emails or messages that appear to be from legitimate businesses, asking them to provide personal information.

The Consequences of Cloning Credit Cards on Businesses

For businesses, the implications of cloned credit cards can be devastating. Financial losses, reputational damage, and legal ramifications are just the tip of the iceberg.

Financial Losses

When a card is cloned and used fraudulently, the original cardholder often disputes the charges, leading to chargebacks that can significantly impact a retailer’s revenue.

Reputational Damage

In an increasingly connected world, news of data breaches travels fast. A business that falls victim to credit card fraud may face a tarnished reputation, leading to loss of consumer trust and reduced sales.

Legal Ramifications

Businesses can also find themselves at the center of legal actions if they are deemed negligent in protecting customer information. Compliance with regulations such as PCI DSS (Payment Card Industry Data Security Standard) is essential for mitigating these risks.

Preventative Measures Against Cloning Credit Card Attacks

Preventing credit card cloning requires proactive measures from both consumers and businesses. Here are some recommended strategies:

For Businesses

- Invest in EMV Technology: Utilizing EMV chip card readers significantly reduces the risk of card cloning.

- Regularly Update Security Protocols: Keep software and security measures updated to defend against new threats.

- Monitor Transactions: Implement systems to detect and alert unusual transactions immediately.

For Consumers

- Use Digital Wallets: Wallet services like Apple Pay or Google Pay add an extra layer of security through tokenization.

- Regularly Check Statements: Vigilant monitoring of account statements can help quickly identify unauthorized transactions.

- Educate Yourself: Understanding phishing tactics can help you avoid falling victim to scams.

The Future of Credit Card Security

The battle against cloning credit cards is ongoing, with new technologies emerging that promise to enhance security. The integration of biometrics, such as fingerprint or facial recognition, is making transactions more secure than ever.

Emerging Technologies

Technologies such as blockchain are being explored for their ability to increase transparency and traceability in transactions. With blockchain, each transaction can be recorded securely, making cloning virtually impossible.

Conclusion

The phrase "cloning credit card" encapsulates a serious issue within the financial world. Understanding how this practice works and its implications is crucial for consumers and businesses alike. By implementing robust security measures, remaining vigilant, and staying updated on technological advancements, we can collectively reduce the prevalence of credit card cloning and make financial transactions safer for everyone.

Final Thoughts

As we evolve in our banking practices and embrace new technologies, staying informed about practices like cloning credit cards is more critical than ever. Knowledge is power; equip yourself with the right information, and you will be better prepared to protect your financial interests.